An analyst has explained how Bitcoin could face significant waves of selling pressure from the short-term holders around these price levels.

Bitcoin Short-Term Holder MVRV Could Flag These Levels As Important

In a new post on X, CryptoQuant author Axel Adler Jr has talked about the trend in the Market Value to Realized Value (MVRV) Ratio of the Bitcoin short-term holders.

The MVRV Ratio is an indicator that keeps track of the ratio between the Bitcoin Market Cap and Realized Cap. The former represents the value currently held by the investors as a whole, while the latter that initially invested by them. As such, this ratio tells us about the profit-loss situation of the network.

When the value of this metric is greater than 1, it means the average investor on the chain is holding a net unrealized profit. On the other hand, it being under the threshold implies the dominance of loss among the holders.

In the context of the current topic, the MVRV Ratio of only a specific part of the market is of interest: the short-term holders (STHs). The STHs refer to the Bitcoin investors who purchased their coins within the past 155 days.

The members of this cohort tend not to be too resolute, so they often react to market happenings. In particular, whenever the profit held by them gets too high, a mass selloff from them can become probable, as they look to realize their gains.

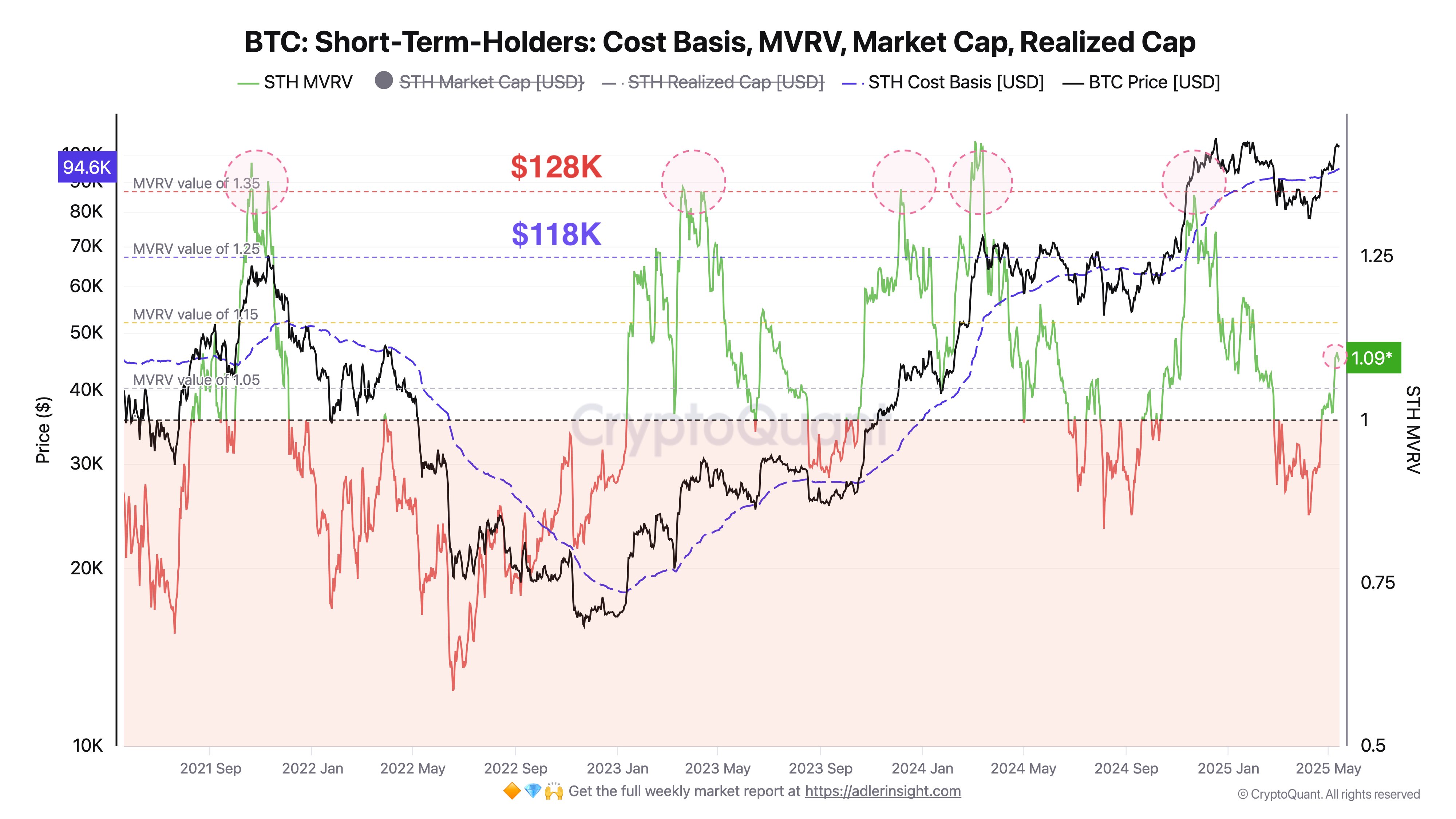

Now, here is the chart shared by the analyst that shows the trend in the Bitcoin STH MVRV Ratio over the last few years:

As is visible in the above graph, the Bitcoin STH MVRV Ratio fell under the 1 mark earlier in the year as the asset’s price declined below the average cost basis of the group.

With the latest recovery rally, the cryptocurrency has managed to break back above the line, putting STHs back into gains. So far, the MVRV Ratio has only reached the 1.09 mark, which isn’t too high when compared to past rallies. As such, it’s possible that the STHs may not be tempted to realize profits en masse just yet.

In the chart, Adler Jr has highlighted two levels where profitability is high enough that significant selling pressure can indeed become likely to arise from this cohort: the 1.25 and 1.35 STH MVRV Ratios. At present, the former is situated at $118,000 and the latter at $128,000.

It now remains to be seen whether Bitcoin will rally high enough to retest these levels—and if it does, whether the STH selloff will act as resistance.

BTC Price

At the time of writing, Bitcoin is trading around $103,200, up over 2% in the last seven days.