Changing macroeconomic conditions and big investment activity are driving Bitcoin near the crucial $97,000 resistance point. Currently selling at about $96,209, the most valuable cryptocurrency is causing both expectation and concern as market players await a breakthrough.

Related Reading

Whale Accumulation Signals Strong Confidence

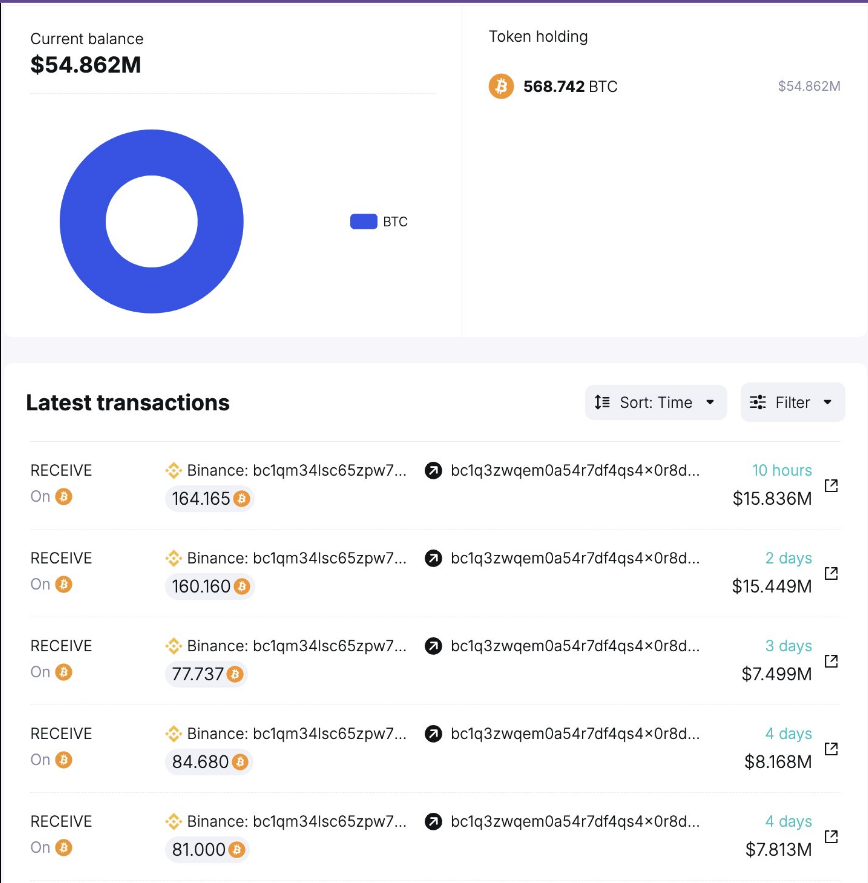

Whales aren’t sitting on the sidelines. From Binance, at an average price of $96,400, a freshly approved wallet recently pulled out 568 BTC, or around $55 million, data from Spot On Chain shows. These high-value withdrawals frequently indicate long-term trust as investors migrate their money from exchanges to safe custody.

Past whale behavior has also hinted notable price fluctuations. If this pace of accumulation keeps on, it may suggest a significant increase reaching $99,500. The question now is whether or not retail investors will adopt this approach.

Fresh #Bitcoin Accumulation Spotted!

A newly created wallet (4 days old) has already withdrawn 568.74 $BTC from #Binance at an average price of $96,769 (est. cost: ~$55.04M).

Is this a bullish signal for $BTC? Follow @spotonchain and track this whale live at… pic.twitter.com/dnRZl8Yok8

— Spot On Chain (@spotonchain) February 17, 2025

Sluggish Greenback Could Give Bitcoin A Boost

Meanwhile, the US Dollar Index (DXY) starts to show signs of weakness, according to a crypto analyst. On its MACD (Moving Average Convergence Divergence), an adverse crossover suggests that the dollar could be losing strength. Based on historical figures, Bitcoin tends to perform well when the US currency weakens, as investors look for alternative stores of value.

Should the DXY downswing persist, it might provide BTC the required impetus to exceed the $97,000 barrier and seek new highs. Still, the strong comeback of the dollar could perhaps slow down Bitcoin’s movement, therefore preserving it within its current trading range.

Price Consolidation Before The Next Big Move

Bitcoin continues to be in a consolidation phase, despite the euphoric sentiment. The resistance at $97,000 has been a significant obstacle, obstructing a straightforward breakout. Traders are currently monitoring whether the flagship crypto can maintain upward momentum or if another rejection will result in a return to lower support levels.

On-chain data indicates that there is a tug-of-war between customers and sellers. Some short-term speculators may be taking profits, which could be contributing to the market’s volatility, while whales continue to accumulate. A decisive move above $99,500 could attract additional purchasers, while a failure to break through may result in another decline.

Related Reading

The Road Ahead For Bitcoin

The charts are the sole focus of attention. The next psychological target could be $100,000 if BTC surpasses $97,000, a level that would reignite mainstream enthusiasm. In contrast, Bitcoin may retreat to support levels around $95,000 before attempting another rally if resistance remains robust.

Featured image from Gemini Imagen, chart from TradingView