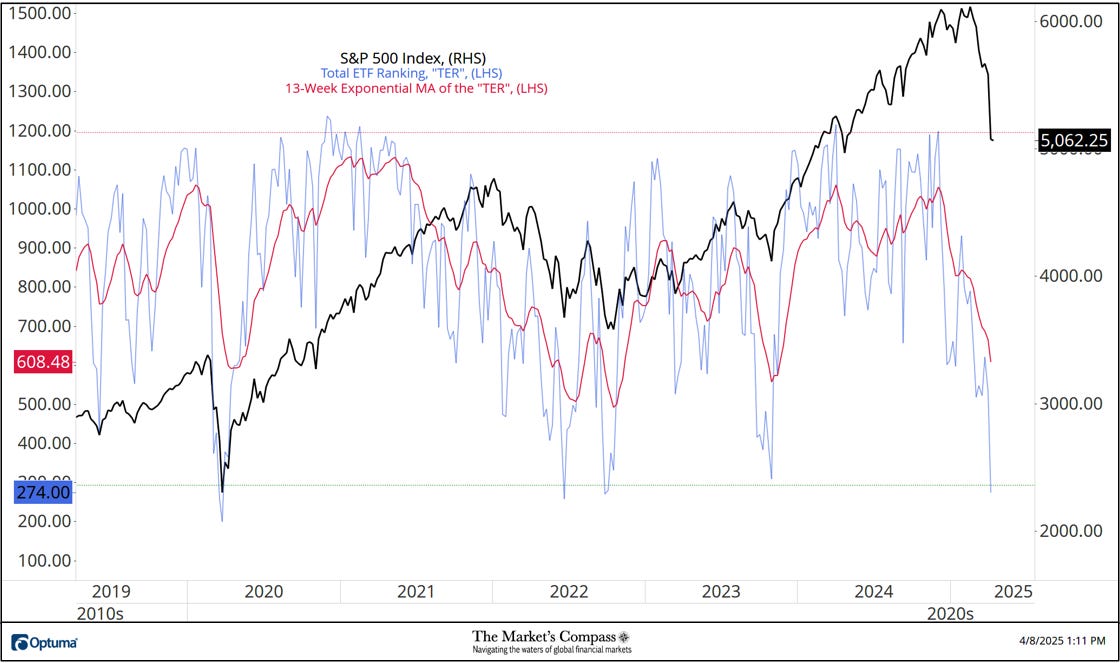

The Total ETF Technical Ranking (“TER”) Indicator is a total of all 30 ETF rankings and can be looked at as a confirmation/divergence indicator as well as an overbought oversold indicator. My paid subscribers are familiar with it. As an overbought/oversold indicator: The closer the TER gets to the 1500 level (all 30 ETFs having a TR of 50) “things can’t get much better technically” and a growing number of individual ETFs have become “stretched” the more of a chance of a pullback in the SPX Index. On the flip side the closer to an extreme low “things can’t get much worse technically” and a growing number of ETFs are “washed out technically” an oversold rally or measurable low is close to be in place. Last week the TER reached an extreme low (274) suggesting at the very least a counter trend rally (likely a 4th wave) will develop in the days to come.