Welcome to this week’s publication of the Market’s Compass Crypto Sweet Sixteen Study #189. The Study tracks the technical condition of sixteen of the larger market cap cryptocurrencies. Every week the Studies will highlight the technical changes of the 16 cryptocurrencies that I track as well as highlights on noteworthy moves in individual Cryptocurrencies and Indexes. As always, paid subscribers will receive this week’s unabridged Market’s Compass Crypto Sweet Sixteen Study sent to their registered email. This week, in celebration of Mother’s Day free subscribers will also receive this week’s Crypto Study. Please consider becoming a paid subscriber. Past publications including the Weekly ETF Studies can be accessed by paid subscribers via The Market’s Compass Substack Blog.

An explanation of my objective Individual Technical Rankings go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and select “crypto sweet 16”. What follows is a Cliff Notes version of the full explanation…

”The technical ranking system is a quantitative approach that utilizes multiple technical considerations that include but are not limited to trend, momentum, measurements of accumulation/distribution and relative strength. The TR of each individual Cryptocurrency can range from 0 to 50”.

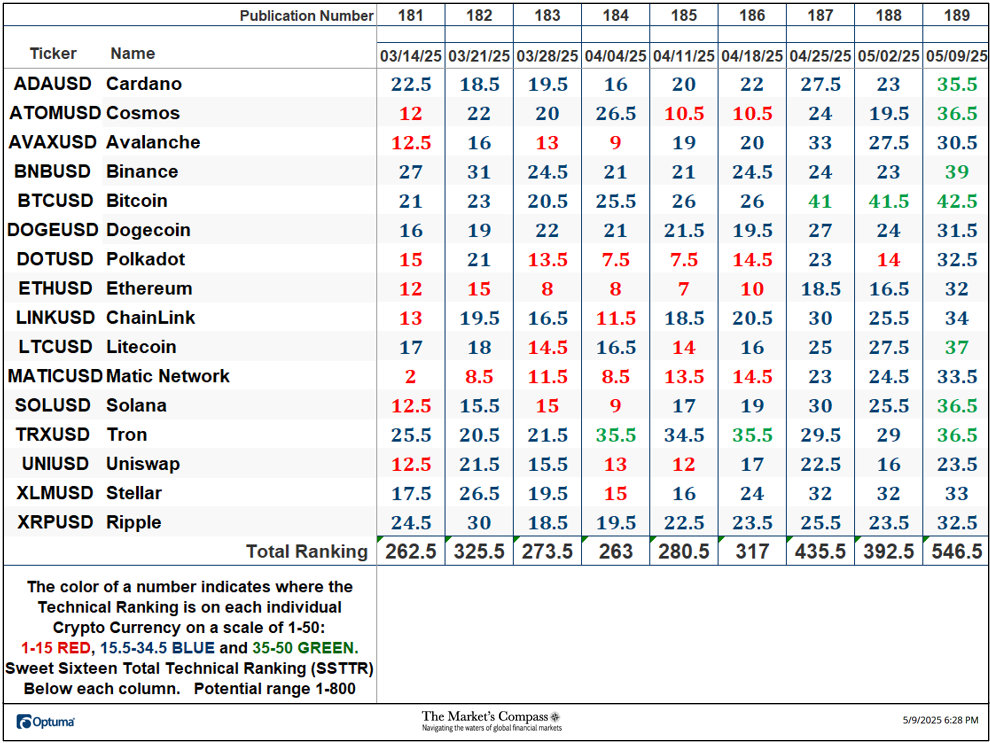

The Excel spreadsheet below indicates the weekly change in the objective Technical Ranking (“TR”) of each individual Cryptocurrency and the Sweet Sixteen Total Technical Ranking (“SSTTR”).

*Rankings are calculated up to the week ending Friday May 9th

The Sweet Sixteen Total Technical Ranking or “SSTTR” rose +39.24% to 546.5 from the previous week’s reading of 392.5. Last week’s reading of 546.5 the highest SSTTR since the January 17th reading of 593.

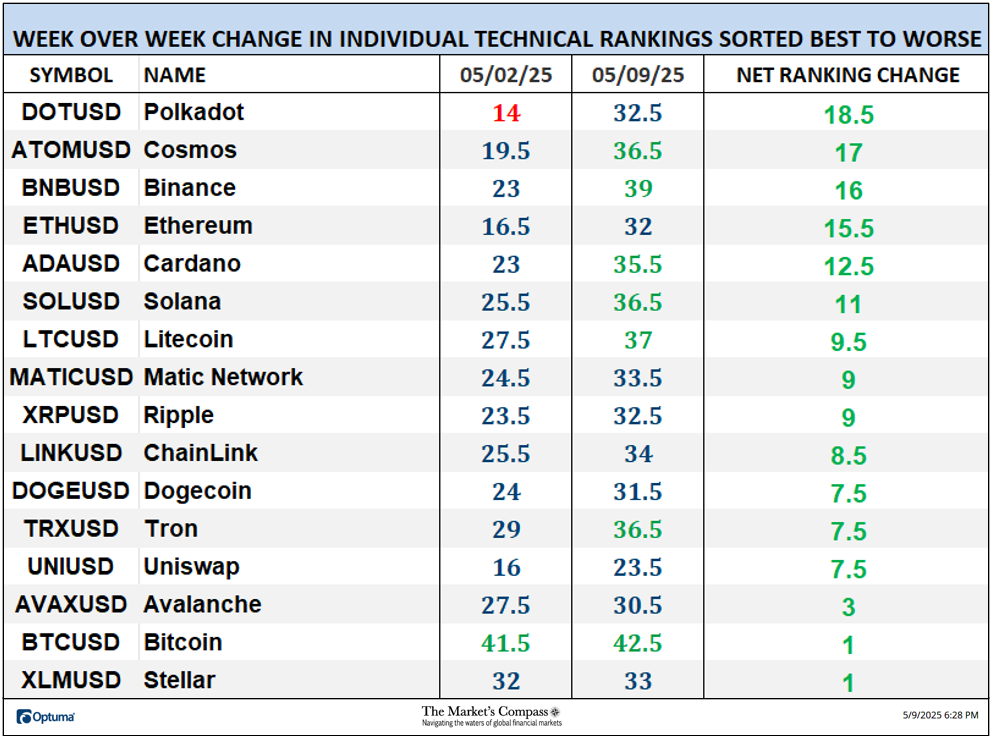

Last week, all sixteen of the Crypto Sweet Sixteen TRs rose. The average Sweet Sixteen TR gain last week was +9.63, vs. the previous week’s average TR loss of -2.69. Seven crypto currencies TRs I track ended the week in the “green zone” (TRs between 35 and 50) with five crypto currencies registering double-digit TR gains. Nine TRs were in the “blue zone” (TRs between 15.5 and 34.5), and there was not one of that we track in these pages was in the “red zone”. That was a marked improvement versus the previous week when, only one was in the “green zone”, twelve were in the “blue zone”, and one was in the “red zone”.

*The CCi30 Index is a registered trademark and was created and is maintained by an independent team of mathematicians, quants and fund managers lead by Igor Rivin. It is a rules-based index designed to objectively measure the overall growth, daily and long-term movement of the blockchain sector. It does so by indexing the 30 largest cryptocurrencies by market capitalization, excluding stable coins (more details can be found at CCi30.com).

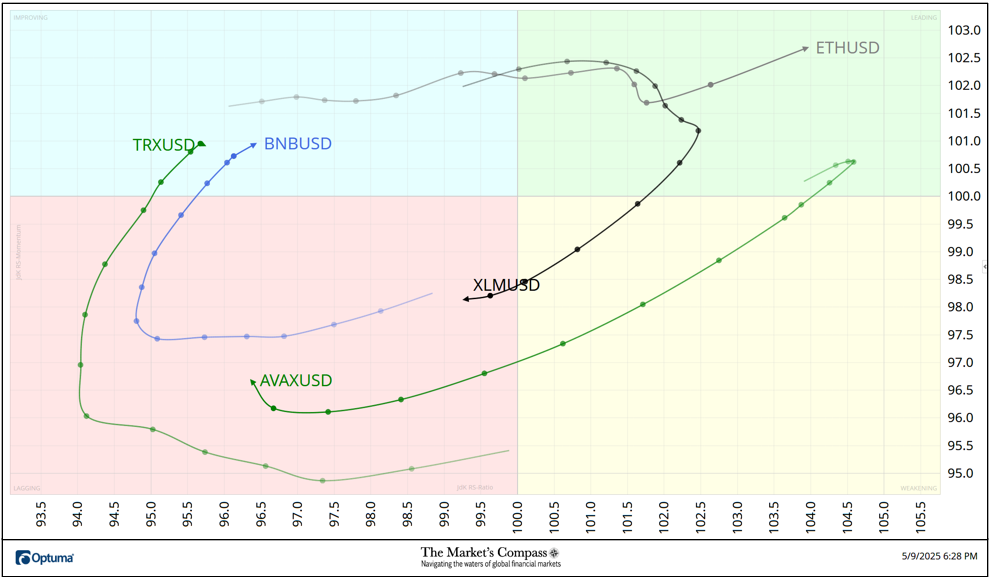

A brief explanation of how to interpret RRG charts can be found at The Market’s Compass website www.themarketscompass.com Then go to MC’s Technical Indicators and select Crypto Sweet 16. To learn more detailed interpretations, see the postscripts and links at the end of this Blog.

The chart below has two weeks, or 14 days, of data points deliniated by the dots or nodes. Not all 16 Crypto Currencies are plotted in this RRG Chart. I have done this for clarity purposes. Those which I believe are of higher technical interest remain.

Ethereum (ETH) ended last week with a reacceleration of Relative Strength Momentum in the Leading Quadrant. Both Stellar (XLM) and Avalanche (AVAX) have entered the Lagging Quadrant with AVAX leading the way lower. Last Week Tron (TRX) turned higher in the Lagging Quadrant with improving Relative Strength Momentum to end the week in the Improving Quadrant in concert with the move in Binance (BNB).

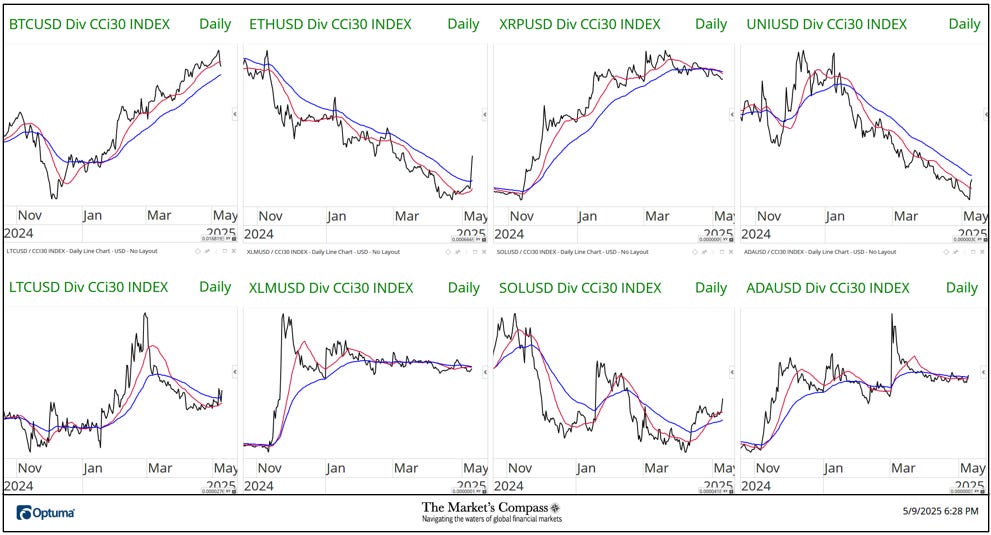

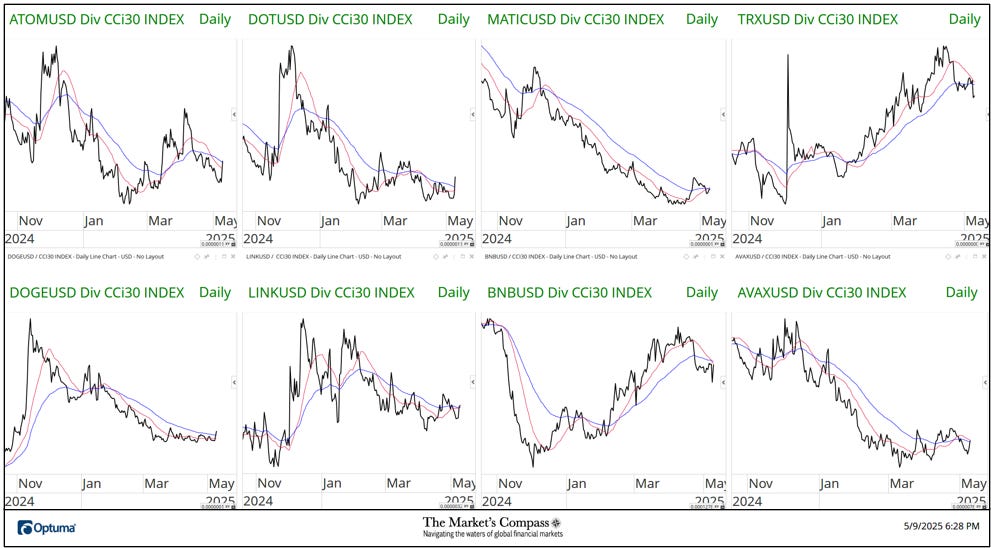

The two panels below contain longer term line charts of the Relative Strength or Weakness of the Sweet Sixteen Crypto Currencies vs. the CCi30 Index that are charted with a 55-Day Exponential Moving Average in blue and a 21-Day Simple Moving Average in red. Trend direction and crossovers, above or below the longer-term moving average, reveals potential continuation of trend or reversals in Relative Strength or Weakness.

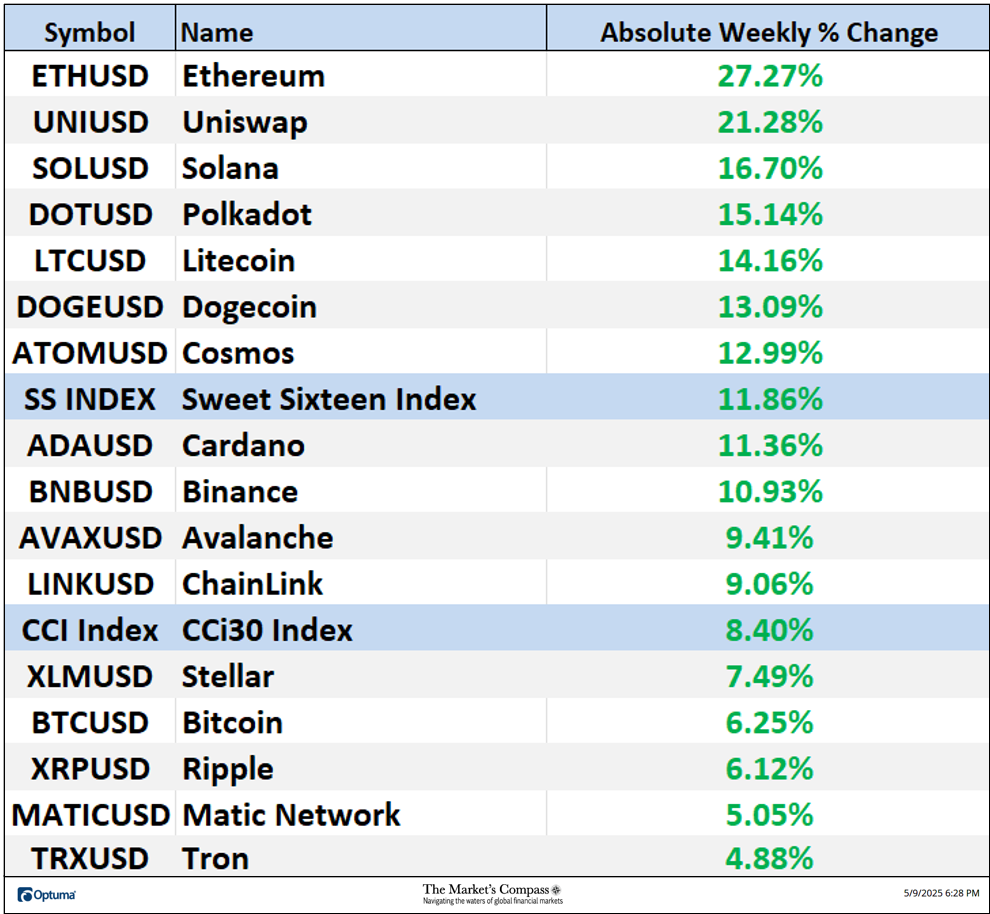

*Friday May 2nd to Friday May 9th

All the Sweet Sixteen gained absolute ground over the seven-day period ending Friday. The seven-day average absolute price gain was +11.95% powered by double digit absolute gains in nine of the Sweet Sixteen, reversing the previous week’s average absolute loss of 1.41% when six gained absolute ground over the seven-day period ending the previous Friday and ten fell on an absolute basis.

*An explanation of my Technical Condition Factors go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and select Crypto Sweet 16.

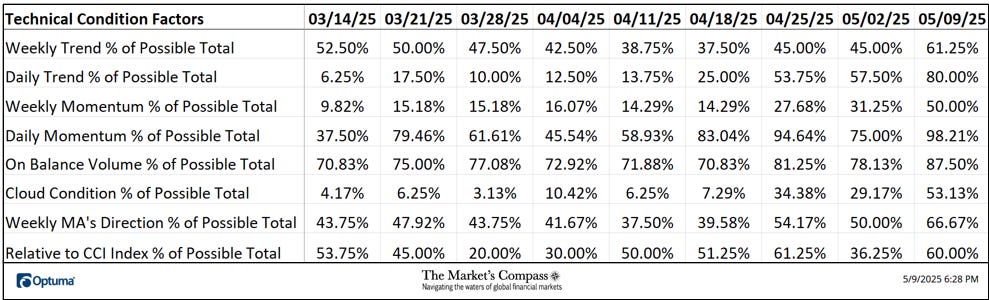

The DMTCF rose last week from 75.00% or 84 the week before to an unquestionable extreme overbought reading of 98.12% or 119 out of a possible 112 last week. Only Matic Network (MATIC) and Avalanche (AVX) kept the DMTCF from registering a reading of 100.0%.

As a confirmation tool, if all eight TCFs improve on a week over week basis, more of the 16 Cryptocurrencies are improving internally on a technical basis, confirming a broader market move higher (think of an advance/decline calculation). Conversely, if more of the TCFs fall on a week over week basis, more of the “Cryptos” are deteriorating on a technical basis confirming the broader market move lower. Last week all eight TCFs rose confirming, as will be seen in the chart below, last week’s rally in the CCi30 Index.

For a brief explanation on how to interpret the Sweet Sixteen Total Technical Ranking or “SSTTR” vs the weekly price chart of the CCi30 Index go to www.themarketscompass.com. Then go to the MC’s Technical Indicators and select Crypto Sweet 16.

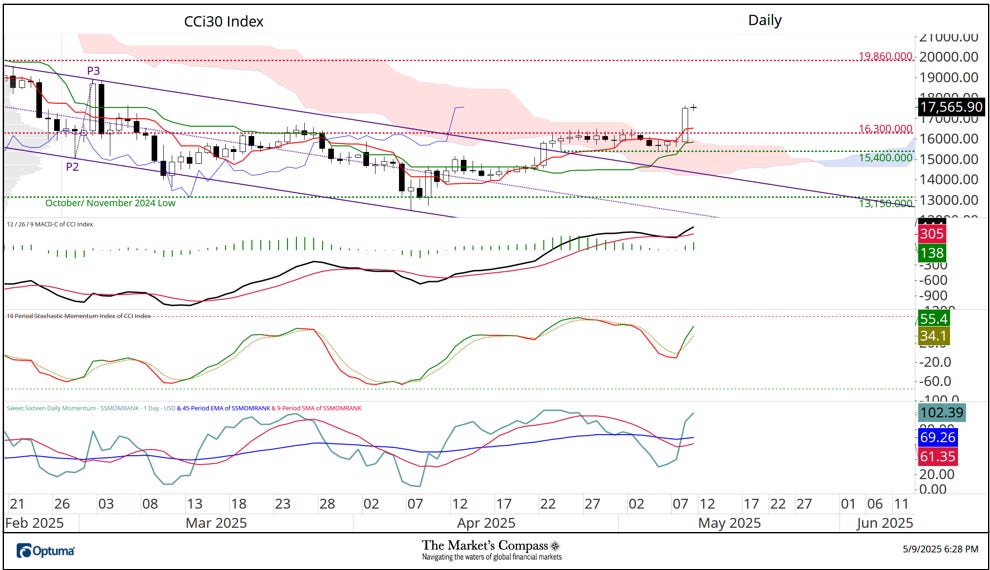

In my published Crypto Sweet Sixteen Study two weeks ago, I suggested that there were early hints in the technical condition of the CCi30 Index, that key resistance at the Median Line (gold dotted line) of the long-term Standard Pitchfork and price resistance at 17,965 would be challenged. That technical thesis was bolstered by the Sweet Sixteen Total Technical Ranking, which was turning up from oversold territory along with a turn in the Stochastic Momentum Index which had hooked higher through its signal line as well as a turn in the Fisher Transform. All three secondary indicators continue to track higher. At Friday’s close the CCi30 Index rallied and closed above the Median Line of Pitchfork, closing just below price resistance at the 17,695 level. The next technical hurdle will be the upper boundary of the downtrend channel (yellow dotted line) and secondary price resistance at 19,860 that marks previously broken price support and the P1 price pivot high. All of that said, it is becoming more and more apparent that an important low was likely registered four weeks ago 12,446.20.

After fourteen days of range bound trading the CCi30 Index barreled through the upper price resistance at the 16,300 level on Thursday in what I have referred to on “X” as a bone fide break out. With that rally MACD has risen back above its signal line as has the shorter-term Stochastic Momentum Index. My Sweet Sixteen Daily Momentum / Breadth Oscillator “lifted off” as well and is back above both moving averages. My only concern is that the Oscillator is approaching overbought territory, but previous resistance at 16,300 should act as firm support in a potential pullback.

Most charting software offers some form of RRG charts, but nothing comes close to Optuma’s, and I urge readers to utilize them on a daily basis. The following links are an introduction and an in-depth tutorial on RRG Charts…

https://www.optuma.com/videos/introduction-to-rrg/

https://www.optuma.com/videos/optuma-webinar-2-rrgs/

To receive a 30-day trial of Optuma charting software go to…

An in-depth comprehensive lesson on Pitchforks and analysis as well as a basic tutorial on the Tools of Technical Analysis is available on my website…