BRC-20 Tokens

“Memecoins” on Bitcoin is probably not what Satoshi Nakamoto envisioned when he released the Bitcoin whitepaper in 2008, but it just might be the mass adoption Bitcoin deserves.

TL;DR

- Bitcoin Ordinals utilized the fact that each individual satoshi can be uniquely identified, akin to serial codes on dollar bills, through inscription by the Ordinals protocol.

- Amid the current memecoin frenzy, BRC-20 tokens emerged as a new “token standard” on Bitcoin, building on the concept of marking single satoshis.

- While Ordinals tagged individual satoshis as NFTs, BRC-20 tokens involve “minting” satoshis containing information about an entire collection of tokens using JSON data.

- BRC-20 tokens have already piqued interest of the crypto community, with the market cap of BRC-20 tokens reaching near $1 billion. However, it has caused transaction fees to spike on the network, which did not click well with some Bitcoiners.

BRC-20 Tokens

it’s tokens have caused a legitimate storm in the Bitcoin community and beyond. Let’s dive into what exactly are Bitcoin memecoins and the impact on BTC.

As explained here:

“Imagine two one-dollar bills. Both are completely fungible but have a serial code, which allows us to identify each dollar bill as unique. But if one bill was signed by Muhammed Ali and George Foreman, it becomes a “dollar NFT” of sorts. You could still spend it as a regular dollar, but the signatures make the bill’s value skyrocket.

Ordinals work in the same manner. They take advantage of the fact that each individual satoshi can be uniquely identified by its equivalent of a serial code.

For example, if you wanted to create a collection of 100 hypothetical $RANDO BRC-20 tokens, you’d mint the collection by inscribing one sat with the relevant JSON data. JSON data can be used to define the token name, symbol, supply and other properties. Users can also use JSON data to mint new tokens or transfer existing tokens to other addresses.

Or to use the dollar/sats metaphor again: you mark one dollar bill with information about 20 $RANDO stickers, which are not dollar bills. You always need a dollar bill to transfer stickers. But the bill does not back the stickers themselves, nor can they do anything.

If this sounds complicated and not intuitive, that’s because it is. Bitcoin was not created for this workaround, as many on Crypto Twitter have pointed out:

This hunger for blockspace surprised the Bitcoin community, and the effect on Bitcoin transaction fees has been significant.

Just when Ordinals were going back to being a niche phenomenon, BRC-20 tokens started rocking the transaction count boat. And rock they did: BRC-20 transactions currently make up a majority of all Bitcoin transactions.

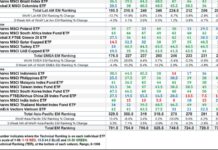

Transaction fees surged to previously unthinkable levels:

Incredibly, transaction fees made up a higher share of miner revenue than the block subsidy for some blocks:

However, not everyone was amused by this surprising spike in activity on Bitcoin.

But it has also caused a new round of infighting between different factions of the Bitcoin community. Eric Wall and Udi Wertheimer both support the second-order effects of the unexpected appetite for Bitcoin blockspace:

This sentiment was shared by Anita Posch, a Bitcoin educator focused on bringing Bitcoin to financially underdeveloped regions in the world:

Some members of the community realize BRC-20 tokens could provide a much-needed impulse for the community to work on the necessary infrastructure improvements:

Now, who said that Bitcoin is boring?

This article contains links to third-party websites or other content for information purposes only (“Third-Party Sites”). The Third-Party Sites are not under the control of CoinMarketCap, and CoinMarketCap is not responsible for the content of any Third-Party Site, including without limitation any link contained in a Third-Party Site, or any changes or updates to a Third-Party Site. CoinMarketCap is providing these links to you only as a convenience, and the inclusion of any link does not imply endorsement, approval or recommendation by CoinMarketCap of the site or any association with its operators. This article is intended to be used and must be used for informational purposes only. It is important to do your own research and analysis before making any material decisions related to any of the products or services described. This article is not intended as, and shall not be construed as, financial advice. The views and opinions expressed in this article are the author’s [company’s] own and do not necessarily reflect those of CoinMarketCap.